A More Complete Process

Thinking in LAYERS Digital Twin Technology revolutionizes location analytics. While conventional methods provide a few common ingredients, Digital Twin Technology gives you the cake. Thinking in LAYERS offers a complete retail location solution that turns a mountain of data into actionable intelligence that effectively lays the foundation for true location optimization...it tells you where to find the best sites to expand or contract your retail business. As a result, Thinking in LAYERS employs a much more complete analytic process.

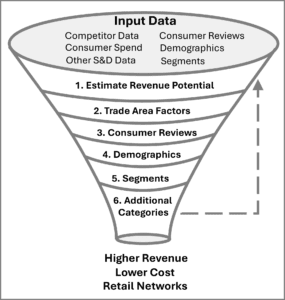

- Estimate Revenue Potential: Estimating revenue potential at the trade area level is the foundation of

Thinking in LAYERS location analytics. It involves building a digital virtual replica of the retail marketplace using a mountain of supply and demand. A model that effectively explains consumer shopping choice (demand side) inside the profitability of the current retail landscape (supply side). It allows retail opportunities to be compared across sites with vastly different market forces. Then with a complete Canada-wide coverage, it guarantee to find the best opportunities, while ensuring none are missed. This is the foundation of true location network optimization!

Thinking in LAYERS location analytics. It involves building a digital virtual replica of the retail marketplace using a mountain of supply and demand. A model that effectively explains consumer shopping choice (demand side) inside the profitability of the current retail landscape (supply side). It allows retail opportunities to be compared across sites with vastly different market forces. Then with a complete Canada-wide coverage, it guarantee to find the best opportunities, while ensuring none are missed. This is the foundation of true location network optimization! - Site Factors: There are a number of other helpful site related factors that don't neatly fit into the above supply, demand and revenue potential metrics.

- Trade Area or Shopping Centre Types: We categorize retail trade areas into 7 unique types of shopping centres: Super Regional, Regional, Large Community, Small Community, Large Neighbourhood, Medium Neighbourhood and Small Neighbourhood. While these overlapping trade area types are used to explain consumer shopping choice across multiple shopping destinations, they are also included in the final results for filtering. For example, small neighbourhood shopping centres are often considered last in the site selection process because they typically have a smaller long-term upside potential than other larger trade areas.

- Trade Area Visibility measures the total number of households living in a trade area. And since households typically buy goods over multiple shopping centres, their trade areas are overlapping, which effectively double counts households in each shopping centre they frequent. For example, a household may purchase groceries in both their closest neighbourhood shopping centre as well as at Costco in their closest regional shopping centre. In contrast, adjusted market size values are used to estimate revenue potential and do not double count households. They measure only households expected to purchase goods and services, and removes the ones living in the trade area but migrating to purchase goods in larger nearby shopping centres. Trade area visibility is a useful measure for the long-term market potential of retailers with above average value propositions.

- Consumer On-line Reviews: Thinking in LAYERS pioneers the ability to incorporate on-line social media metrics into the retail location process. Brand awareness and sentiment are two leading indicators that we use to measure and track the health, performance, potential risks, and opportunities of a location. Brand awareness is based on the number of Google reviews and is a good indicator of the reach or penetration of a brand. Brand sentiment is based on the average Google rating and measures the reputation of a brand at the local level, which is often tied directly to sales. It can be used in evaluating the performance of a retail network, and to help identify gaps in the service offerings of competitors in the site selection process.

- Demographics: Thinking in LAYERS provides the means to include demographics into the location analytic process. While often used as a major driver in conventional location analytics, they are only included in the analytic process after revenue potential is estimated for the entire market. Thinking in LAYERS provides a summary analysis that compares the strength of individual demographic variables with the trade area performance of its retail network. These findings can then be used to identify and filter sites in the site selection process. For example, a jewelery store may want to filter potential new sites to include only sites with a high proportion of households with an income over $200,000.

- Consumer Segments: Thinking in LAYERS provides the means to integrate geo-demographic or customer segments into the location analytic process. Panorama is our own segmentation system built with our partner Applied Geographic Solutions that covers both Canada and the US. It consists of 26 groups and 99 segments. There are two ways to include consumer segments:

- No previously segmented customers. Thinking in LAYERS provides a summary analysis that compares individual Panorama consumer groups with a retail brand’s network of sites. These findings can then be used to evaluate the performance of a network and identify and filter sites in the site selection process.

- Previously segmented customers. The best way to integrate consumer segments is to first segment your existing customer base. This involves matching postal codes from your customer base with the postal codes of the segmentation system. Segments from the best customers are then used to find other trade areas with these same segments in the site selection process. Please contact us for more information.

- Additional Retail Categories: Thinking in LAYERS allows the inclusion of multiple retail categories into the analytic process by including them in a recursive analytic process. Some retailers carry a wide variety of products that span multiple retail categories, while others like restaurants compete in multiple retail categories. For example, an American fast food restaurant would primarily compete against other American fast-food places, but would also compete against other ethnic fast-food and full-serve restaurants. Thinking in LAYERS offers over 200 retail categories for analysis with the ability to create additional custom retail categories.

Why a New Solution

The problem with current location methods is they use simple trade area definitions that limit consumers to buying goods in one trade area at a time. They can't account for the real-life complexity of purchases across multiple trade area shopping centres. This ultimately means that trade areas double-count demand and result in over-competitive clusters in some locations and large gaps and hidden opportunities in others. This leads to low revenue and high-cost retail networks.

How Thinking in Layers Solves the Problem

Thinking in LAYERS uses supply and demand within a system of trade area layers to model consumer buying behaviour across multiple trade areas. It doesn't double-count consumer spending, and therefore, metrics can be measured and compared across vastly different trade areas. It means no more over-competitive retail clusters. It finds the opportunities hidden by current location methods and ensures none are missed across Canada. This leads to optimized retail networks with higher revenue and lower costs.

What Thinking in Layers Delivers

Thinking in LAYERS is a Canada-wide dedicated Digital Twin location model that delivers detailed custom location intelligence, usually reserved for the Fortune 500, but with the speed of on-demand reports. Reports compare, score and rank the performance and opportunity of almost 200 retail store type categories across almost 5,000 trade areas in Canada. Its how we guarantee to find the best opportunities, while ensuring none are missed...and without stumbling into over-competitive retail cluster traps.