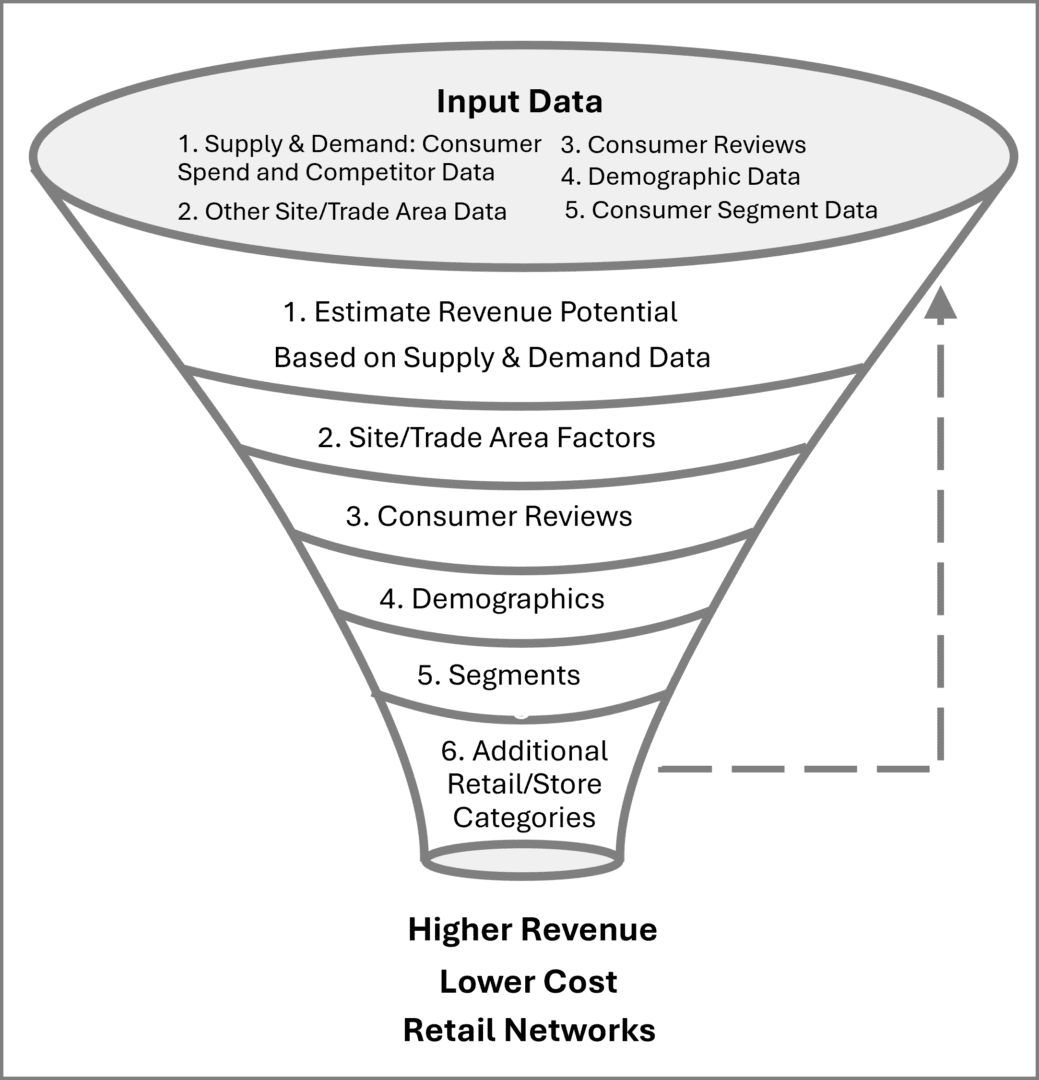

A More Complete Process

Thinking in LAYERS Digital Twin Technology revolutionizes location analytics. While conventional methods provide a few common ingredients, Digital Twin Technology bakes the cake. This essentially requires explaining the complexity of the consumer retail purchase experience, or put another way, it means we have to get the right mix of ingredients to bake the cake. It's why we've spent the last decade using the most advanced spatial econometric methods on a mountain of input supply and demand data to help us accurately simulate the consumer purchase behaviour, which is then turned into actionable intelligence.

Figure 1: Thinking in LAYERS Analytical Process

- Estimate Revenue Potential: Estimating revenue potential using both supply and demand is the foundation of Thinking in LAYERS. This is first and most important piece...it's the flour in the cake! It involves simulating the retail marketplace using a mountain of supply and demand data and multiple trade area layers. For more information, see how it works. This is the breakthrough because it allows Thinking in LAYERS to effectively explain consumer shopping choice (demand side) inside the profitability of the current retail landscape (supply side). This effectively creates the foundation of true location network optimization: the ability to accurately compare retail opportunities across sites with vastly different market forces. Then with a complete Canada-wide coverage, it guarantees to find the best opportunities, while ensuring none are missed.

- Site Factors: There are a number of other helpful site related factors that don't neatly fit into the above supply, demand and revenue potential metrics.

- Trade Area or Shopping Centre Types: We categorize retail trade areas into 7 unique types of shopping centres: Super Regional, Regional, Large Community, Small Community, Large Neighbourhood, Medium Neighbourhood and Small Neighbourhood. While these overlapping trade area types are used to explain consumer shopping choice across multiple shopping destinations, they are also included in the final results for filtering. For example, small neighbourhood shopping centres are often considered last in the site selection process because they typically have a smaller long-term upside potential than other larger trade areas.

- Trade Area Visibility measures the total number of households living in a trade area. And since households typically buy goods over multiple shopping centres, their trade areas are overlapping, which effectively double counts households in each shopping centre they frequent. For example, a household may purchase groceries in both their closest neighbourhood shopping centre as well as at Costco in their closest regional shopping centre. In contrast, adjusted market size values are used to estimate revenue potential and do not double count households. They measure only households expected to purchase goods and services, and removes the ones living in the trade area but migrating to purchase goods in larger nearby shopping centres. Trade area visibility is a useful measure for the long-term market potential of retailers with above average value propositions.

- Public Spaces Database: We have also integrated a comprehensive public spaces database (over 200 categories) into the analytic process. The data enriches the overall understanding of the services inside and in close proximity to the trade area. Analytics are filtered based on the proximity of the trade area to metro train stops, bus stops, parks, hotels, airports, convention centres, schools, colleges/universities, sports facilities, police stations, fire stations, cultural centres, museums and much more.

- Consumer On-line Reviews: Thinking in LAYERS pioneers the ability to incorporate on-line social media metrics into the retail location process. Brand awareness and sentiment are two leading indicators that we use to measure and track the health, performance, potential risks, and opportunities of a location. Brand awareness is based on the number of Google reviews and is a good indicator of the reach or penetration of a brand. Brand sentiment is based on the average Google rating and measures the reputation of a brand at the local level, which is often tied directly to sales. It can be used in evaluating the performance of a retail network, and to help identify gaps in the service offerings of competitors in the site selection process.

- Demographics: Thinking in LAYERS provides the means to include demographics into the location analytic process. While often used as a major driver in conventional location analytics, they are only included in the analytic process after revenue potential is estimated for the entire market. Thinking in LAYERS provides a summary analysis that compares the strength of individual demographic variables with the trade area performance of its retail network. These findings can then be used to identify and filter sites in the site selection process. For example, a jewelry store may want to filter potential new sites to include only sites with a high proportion of households with an income over $200,000.

- Consumer Segments: Thinking in LAYERS provides the means to integrate Geo-demographic or customer segments into the location analytic process. Panorama is our own segmentation system built with our partner Applied Geographic Solutions that covers both Canada and the US. It consists of 26 groups and 99 segments. There are two ways to include consumer segments:

- No previously segmented customers. Thinking in LAYERS provides a summary analysis that compares individual Panorama consumer groups with a retail brand’s network of sites. These findings can then be used to evaluate the performance of a network and identify and filter sites in the site selection process.

- Previously segmented customers. The best way to integrate consumer segments is to first segment your existing customer base. This involves matching postal codes from your customer base with the postal codes of the segmentation system. Segments from the best customers are then used to find other trade areas with these same segments in the site selection process. Please contact us for more information.

- Additional Retail/Store Categories: Thinking in LAYERS allows the inclusion of multiple retail or store categories into the analytic process by including them in a recursive analytic process. Some retailers carry a wide variety of products that span multiple retail categories, while others like restaurants compete in multiple retail categories. For example, an American fast food restaurant would primarily compete against other American fast-food places, but would also compete against other fast-food and full-serve restaurants. Thinking in LAYERS handles the complexity of the marketplace by analyzing each retail category separately. For example, the trade area opportunity results (after step 5) using the the first retail category is fed back into step 1 using the second retail category and so on with multiple retail categories. Thinking in LAYERS offers over 200 retail categories for analysis, and with the ability to create additional custom retail categories.

Why a New Solution

The problem with current location methods is they use simple trade area definitions that limit consumers to buying goods in one trade area at a time. They can't account for the real-life complexity of purchases across multiple trade area shopping centres. This ultimately means that trade areas double-count demand and result in over-competitive clusters in some locations and large gaps and hidden opportunities in others. This leads to low revenue and high-cost retail networks.

How Thinking in Layers Solves the Problem

Thinking in LAYERS uses supply and demand within a system of trade area layers to model consumer buying behaviour across multiple trade areas. It doesn't double-count consumer spending, and therefore, metrics can be measured and compared across vastly different trade areas. It means no more over-competitive retail clusters. It finds the opportunities hidden by current location methods and ensures none are missed across Canada. This leads to optimized retail networks with higher revenue and lower costs.

What Thinking in Layers Delivers

Thinking in LAYERS is a Canada-wide dedicated Digital Twin location model that delivers detailed custom location intelligence, usually reserved for the Fortune 500, but with the speed of on-demand reports. Reports compare, score and rank the performance and opportunity of almost 200 retail store type categories across almost 5,000 trade areas in Canada. Its how we guarantee to find the best opportunities, while ensuring none are missed...and without stumbling into over-competitive retail cluster traps.